Women’s power and influence in our society and economics has been growing rapidly. It is a beautiful accomplishment and a rewarding sight. Yet many of us if we are not in that space or serve that space may never truly understand the economics and challenges.

The material below was written by a different author and I’m sharing it as a resource to help better understand and cater to women / women founders / women consumers. I have always loved women both the beautiful and the ugly aspect of womanhood. Do I hundred percent get women, probably not but I do know men and women pretty much want the same things, From safety, access, resources, belonging, love, care, rights, fairness, power, freedom, etc

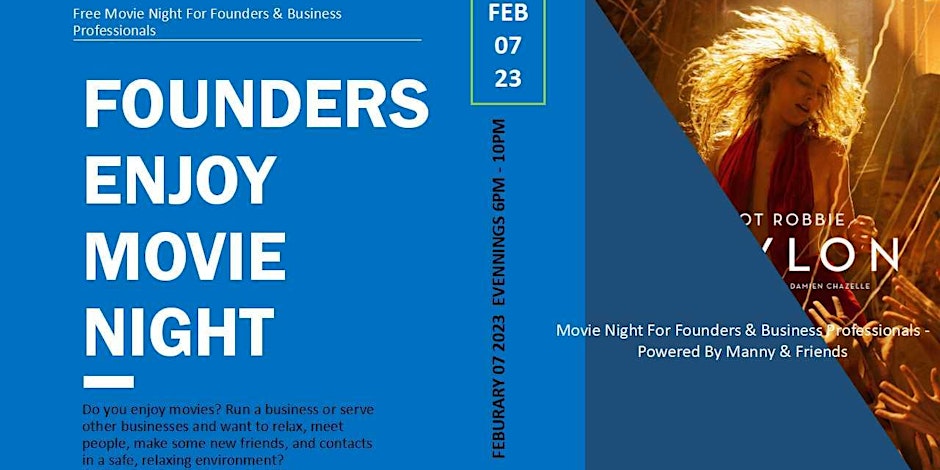

As always I & FOUNDERS UNDER 40™ GROUP welcomes more women, LGBTA, men, religious, non-religious, hulks, etc. We wanted to do a better job.

Plus, if you are in need of getting more leads and attentions give us a shout [info(at)foundersunder40.com] or visit http://www.bjmannyst.com

The Female Economy

Original Authors: Michael J. Silverstein and Kate SayreWomen now drive the world economy.

Globally, they control about $20 trillion in annual consumer spending, and that figure could climb as high as $28 trillion in the next five years. Their $13 trillion in total yearly earnings could reach $18 trillion in the same period. In aggregate, women represent a growth market bigger than China and India combined—more than twice as big, in fact. Given those numbers, it would be foolish to ignore or underestimate the female consumer. And yet many companies do just that, even ones that are confident they have a winning strategy when it comes to women.Consider Dell’s short-lived effort to market laptops specifically to women. The company fell into the classic “make it pink” mind-set with the May 2009 launch of its Della website. The site emphasized colors, computer accessories, and tips for counting calories and finding recipes. It created an uproar among women, who described it as “slick but disconcerting” and “condescending.” The blogosphere reacted quickly to the company’s “very special site for women.” Austin Modine of the online tech publication The Register responded acidly, “If you thought computer shopping was a gender-neutral affair, then you’ve obviously been struck down by an acute case of female hysteria. (Nine out of ten Victorian-age doctors agree.)” The New York Times said that Dell had to go to the “school of marketing hard knocks.” Within weeks of the launch, the company altered the site’s name and focus. “You spoke, we listened,” Dell told users. Kudos to Dell for correcting course promptly, but why didn’t its marketers catch the potentially awkward positioning before the launch?

Most companies have much to learn about selling to women. In 2008 the Boston Consulting Group fielded a comprehensive study of how women felt about their work and their lives, and how they were being served by businesses. It turned out there was lots of room for improvement. More than 12,000 women, from more than 40 geographies and a variety of income levels and walks of life, responded to our survey. They answered—often with disarming candor—120 questions about their education and finances, homes and possessions, jobs and careers, activities and interests, relationships, and hopes and fears, along with their shopping behavior and spending patterns in some three dozen categories of goods and services. (You can learn more about the survey and take an abridged version of it at www.womenspeakworldwide.com.) We also conducted hundreds of interviews and studied women working in 50 organizations in 13 fields of endeavor.

Here’s what we found, in brief: Women feel vastly underserved. Despite the remarkable strides in market power and social position that they have made in the past century, they still appear to be undervalued in the marketplace and underestimated in the workplace. They have too many demands on their time and constantly juggle conflicting priorities—work, home, and family. Few companies have responded to their need for time-saving solutions or for products and services designed specifically for them.

It’s still tough for women to find a pair of pants, buy a healthful meal, get financial advice without feeling patronized, or make the time to stay in shape. Although women control spending in most categories of consumer goods, too many businesses behave as if they had no say over purchasing decisions. Companies continue to offer them poorly conceived products and services and outdated marketing narratives that promote female stereotypes. Look at the automotive industry. Cars are designed for speed—not utility, which is what really matters to women. No SUV is built to accommodate a mother who needs to load two small children into it. Or consider a recent ad for Bounty paper towels, in which a husband and son stand by watching a spill cross the room, until Mom comes along and cheerfully cleans up the mess.

Meanwhile, women are increasingly gaining influence in the work world. As we write, the number of working women in the United States is about to surpass the number of working men. Three-quarters of the people who have lost jobs in the current recession are men. To be fair, women are still paid less, on average, than men, and are more likely to work part-time—factors that have helped insulate them somewhat from the crisis. Nevertheless, we believe that as this recession abates, women not only will represent one of the largest market opportunities in our lifetimes but also will be an important force in spurring a recovery and generating new prosperity.

Where the Opportunities Lie

Each person’s story is different, but when we looked for patterns in our findings, we identified six basic archetypes among our respondents. These types, which are primarily defined by income, age, and stage of life, are fast-tracker, pressure cooker, relationship focused, managing on her own, fulfilled empty nester, and making ends meet. Few women fall into just one type. Married fast-trackers with children, for instance, are likely at some point in their lives to also fall into the pressure cooker category. (See the exhibit “Six Key Female Consumer Segments.”)Despite its limitations, such segmentation is useful in informing the development and marketing of companies’ offerings. Knowing whom you’re targeting and what she looks for in the marketplace can be a tremendous source of advantage.

Women make the decision in the purchases of 94% of home furnishings…92% of vacations…91% of homes… 60% of automobiles…51% of consumer electronics

Any company would be wise to target female customers, but the greatest potential lies in six industries. Four are businesses where women are most likely to spend more or trade up: food, fitness, beauty, and apparel. The other two are businesses with which women have made their dissatisfaction very clear: financial services and health care.

Food represents one of the largest opportunities. Women are responsible for the lion’s share of grocery shopping and meal preparation. Food is also one of consumers’ most important budget items, one that can be adjusted but never eliminated.

Favorite grocery stores among the women we surveyed included Whole Foods and Tesco. Though they appeal to different segments, the two chains have each developed a loyal following. Whole Foods has succeeded despite its high prices by targeting the demanding (but well-to-do) fast-trackers, who want high-quality meats and produce and a knowledgeable staff. Tesco stores, which offer one-stop shopping for a wide range of household items, including books, furniture, and financial services, appeal to the time-strapped pressure cookers, who desire convenience.

Fitness is also a big business. In the United States alone the market for diet food has been growing 6% to 9% a year and is worth approximately $10 billion, while the worldwide market is worth about $20 billion. The U.S. health club industry generates revenues of about $14 billion annually.

About two-thirds of our survey respondents described themselves as overweight; what was until recently an American issue has become a global phenomenon. But while women say that their fitness is a priority, in reality it tends to take a backseat. When asked to prioritize the needs of spouses, children, parents, and themselves, nearly all women ranked their own needs second or third—which means they have trouble finding time to work out.

The challenge for companies is to make fitness more accessible to women. For instance, most health clubs are expensive and designed for men. They can feel more like nightclubs than fitness centers and are geared to bodybuilders. Generally, women are less interested in pumping themselves up than in shedding a few pounds, improving their cardiovascular health, and getting toned. Bright lights, electronic music, sweaty men, and complicated equipment are often a turnoff.

The fitness chain Curves recognized and responded to women’s concerns—and grew quickly as a result. Curves has a very simple concept: cheap, fast exercise for women only, with no-frills spaces suited to middle-aged clients of average build. Helpers stand by to usher them through a simple 30-minute circuit, so there’s no need to hire a trainer.

Beauty products and services promote a sense of emotional well-being in women. Those we talked with who spent a higher portion of their income on cosmetics felt more satisfied, successful, and powerful; they also reported lower levels of stress even if they worked longer hours.

But even so, women are fundamentally dissatisfied with beauty offerings, and the way the industry is evolving keeps them from spending as much as they might. For one thing, there are too many choices; it’s a male-dominated industry in which men make hit-or-miss guesses about what women want, and products come and go at a rapid pace. Women are passionate about the industry and well represented in jobs at the entry level, but female employment drops off at the executive and senior leadership levels. A good first step toward gaining market share might be to put more women at the top—where they can help make key decisions and provide input about what does and doesn’t resonate with customers.

Many companies that do well in beauty have made creative use of new technologies to address women’s desire to look younger. Facial skin-care products, for instance, have grown into a $20 billion category worldwide. Whereas shelves used to be lined with products whose sole purpose was to moisturize the skin, now there are formulas containing a variety of benefits, such as sun protection, skin plumping, and capillary strengthening—all designed to prevent, or at the very least disguise, aging.

At the top of the range is Switzerland-based La Prairie’s Cellular Cream Platinum Rare antiaging moisturizer, which goes for $1,000 for 1.7 ounces. The cream contains a trace of platinum, which, the company claims, “recharges the skin’s electrical balance and protects the skin’s DNA.” Despite the price, customers lined up at luxury retail stores to purchase a jar when the cream was introduced in 2008.

At the other end of the range, Procter & Gamble’s Olay brand is available in drugstores. It has morphed from one low-end product with a simple purpose (moisturizing), which about 2% of the population used, into an array of higher-end products with numerous applications and a 40% household penetration. One of the most successful new Olay products is its Regenerist Daily Regenerating Serum, advertised as the next-best thing to cosmetic surgery.

Apparel—including accessories and shoes—is a $47 billion global industry with plenty of room for improvement, primarily when it comes to fit and affordability.

Most women are not a perfect size 6, and they don’t like to be reminded of it every time they shop. Trying on clothes is often an exercise in frustration that just reinforces women’s negative body images. Banana Republic, a favorite retailer of the women in our survey, has won a loyal following by taking steps to solve the problem of fit, particularly for pants. It offers a variety of cuts to suit different figures, and sizes are consistent across the board. Once you discover your “fit block” (the chain’s technical term for body type), you can buy multiple pairs of pants, even online, quickly and dependably. Banana Republic has become Gap’s most profitable brand, the only one that’s grown over the past five years.

By contrast, Express stores focused on style and color but failed to deliver a consistent fit. Women might try on four garments marked “size 8” that actually varied in size from 6 to 12. The chain’s sales began to lag so much that its parent company, Limited Brands, ended up exiting the fashion apparel business; it sold Express to a private equity group in 2007.

The costliness of clothing was another sore point for the women in our survey. That explains why respondents also favored Sweden-based H&M. Its stores offer inexpensive, fun, trendy clothes and, with a rapid turnover of stock, an element of surprise each time shoppers visit. Women value the ability to buy a new outfit without breaking the bank. Perhaps contributing to H&M’s success is the fact that nearly 80% of the company’s employees, 77% of store managers, and 44% of country managers are women. So are seven of the 11 board members.

Few of the women we talked to during the course of our research actually needed new clothing. Most could get away with shopping once or twice a year just to replenish the basics. But given that women say they are willing to spend extra to find clothing that really works for them, manufacturers and retailers can find plenty of untapped potential in the apparel market—if they listen carefully to what women want, seek new technologies that offer superior fabrication and color, and improve comfort and fit.

Financial services wins the prize as the industry least sympathetic to women—and one in which companies stand to gain the most if they can change their approach.

Despite setbacks in the economy, private wealth in the United States is expected to grow from some $14 trillion today to $22 trillion by 2020, and 50% of it will be in the hands of women. Yet women are still continually let down by the level of quality and service they get from financial companies, which presume men to be their target customers.

Our survey respondents were scathing in their comments about financial institutions. They cited a lack of respect, poor advice, contradictory policies, one-size-fits-all forms, and a seemingly endless tangle of red tape that leaves them exhausted and annoyed. Consider just a few quotations from our interviews:

• “I hate being stereotyped because of my gender and age, and I don’t appreciate being treated like an infant.”

• “As a single woman, I often feel that financial services institutions aren’t looking for my business.”

• “Financial service reps talk down to women as if we cannot understand more than just the basics.”

• “I’m earning close to $1 million a year and should retire with $20 million plus in assets, so I’m not right for a cookie cutter discount broker, nor qualified for high-end wealth management services.”

An unhappy customer with $20 million plus to invest represents a golden opportunity. Overall, the markets for investment services and life insurance for women are wide open. (For three of the largest opportunities, see the exhibit “Financial Categories Where Untapped Sales to Women Are Worth Trillions.”)

Financial Categories Where Untapped Sales to Women Are Worth Trillions

Extraordinary amounts of money are up for grabs in the financial services business. The most lucrative opportunities for companies arise at transition points like marriage, divorce, childbirth, and a job change, because women are most likely to make investment decisions around such events.

[Manny: Thought this figure could be useful for general understanding of women & the economy. I welcome more thoughts and resources from Women & Men info[AT]foundersunder40.com]

Health care was a source of frustration for women in our survey—and for middle-aged respondents in particular. Women resoundingly reported dissatisfaction with their hospitals and doctors. When polled about the service provided by their general practitioners and specialists, more than 60% of them said those doctors could do “somewhat better” or “significantly better.” Seventy-one percent of women aged 30 to 49 were dissatisfied with general practitioners, and 68% of that group were dissatisfied with specialists. More specifically, they were irritated by the amount of time they spent waiting for doctors and lab results, and scheduling and keeping appointments for themselves and their families. Making matters worse, women generally pay significantly more than men do for health insurance.

Again, the opportunities for companies that do cater to women are enormous. Johnson & Johnson, though not a health care services provider, was almost invariably represented (in the form of oral contraception, baby care, bandages, and other products) when we peeked into our respondents’ medicine cabinets. The company spends 4% of its sales on consumer research and development—more than twice the industry average—and thus in all likelihood has a better understanding of its female customers than most companies in its space do.

For instance, because mothers of young children are one of its important customer groups, the company conducted a clinical study in partnership with a pediatric sleep expert at the Children’s Hospital of Philadelphia. Together, they developed a three-step routine to help babies sleep better, consisting of bath, massage, and quiet time. J&J then launched a line of products to complement the routine—with the results of the clinical study to boost their credibility.

Overburdened and Overwhelmed.

Considering how often the issue of time—and not enough of it—came up in our survey and our interviews, offering easier and more convenient ways to make purchases would create a clear advantage in all the industries we’ve discussed. We’ve seen that women don’t make enough time for themselves. They are still far more burdened than men by household tasks; according to our survey, about one-third of men don’t help their spouse or partner with chores. In Japan women receive the least support, with 74% getting little or no help from their spouses. At the opposite extreme, 71% of Indian husbands pitch in on household chores.Our research also showed that pressures change over time. Women are happiest in their early and later years and experience their lowest point in their early and mid forties. That’s when they face the greatest challenges in managing work and home, and must deal with caring for both children and aging parents. So this group is especially receptive to products and services that can help them better control their lives and balance their priorities.

A Future of Parity, Power, and Influence

When the dust from the economic crisis settles, we predict, women will occupy an even more important position in the economy and the world order than they now do. What might that economy look like? In some ways it will be characterized by the same trends we’ve seen over the past five decades. For one thing, women will represent an ever-larger proportion of the workforce. The number of working women has been increasing by about 2.2% a year. We expect an additional 90 million or so women to enter the workforce by 2013, perhaps even more as employment becomes a necessity. At nearly every major consumer company, most middle managers are women. It’s only a matter of time before they rise to more-senior positions. Already, women own 40% of the businesses in the United States, and their businesses are growing at twice the rate of U.S. firms as a whole. (Admittedly, the numbers are being skewed as small businesses position themselves for government contracts that favor female-owned companies.) Women will also continue to struggle with work/life balance, conflicting demands, and too little time.Once companies wake up to the potential of the female economy, they will find a whole new range of commercial opportunities in women’s social concerns. Women seek to buy products and services from companies that do good for the world, especially for other women. Brands that—directly or indirectly—promote physical and emotional well-being, protect and preserve the environment, provide education and care for the needy, and encourage love and connection will benefit.

And women are the customer. There’s no reason they should settle for products that ignore or fail to fully meet their needs, or that do so cynically or superficially. Women will increasingly resist being stereotyped, segmented only by age or income, lumped together into an “all women” characterization, or, worse, undifferentiated from men.

The financial crisis will come to an end, and now is the time to lay the foundation for postrecession growth. A focus on women as a target market—instead of on any geographical market—will up a company’s odds of success when the recovery begins. Understanding and meeting women’s needs will be essential to rebuilding the economy; therein lies the key to breakout growth, loyalty, and market share.

A version of this article appeared in the September 2009 issue of Harvard Business Review.

Original author: Michael J. Silverstein

SPONSOR - - -

So here are my, Manny of BJ Mannyst, take away for founders engaging and selling in the world of women empowerment-economics

- How can B2B companies rise up to the challenge of successfully connecting with the increasing number of female decision-makers and becoming more competitive?’

- Moreover, they form a majority of university graduates and are starting new businesses at a higher rate than men.

- Evidence is emerging that women make decisions differently from men in business, just as they do in the consumer world.

- Not many businesses have actually adopted a tailored approach to female decision-makers,and not many have plans to do more in the future.

- Labour force participation rates around the world have been declining for men and generally rising or stable for women over the past two decades. As a consequence of this trend, which seems likely to continue, women’s presence in the workplace has grown.

- Statistics show that women now account for one third of managers, directors, and senior personel.

- IIt's reported that women attach less importance than men to rituals (such as being wined and dined by top executives) and feel less constrained by rules, regulations, and traditional ways of doing business.

- Deepen relationships with women by reaching out and by organizing external events with female buyers, female influences, and opinion leaders of either gender:

- So being inclusive is the right thing to do. But this is not about being cuddly—it’s about competitive advantage. This competitive advantage applies to gender. It also applies to ethnic background, religious belief, disability, or sexual orientation.

[Some women turn to entrepreneurship because

they have become dissatisfied with the corporate

environment. The Guardian Life Index found that

women cited “office politics” as a key factor in leaving

corporate roles to start their own businesses. “Many

women dislike a highly competitive environment and

may be drawn to one that is more collaborative,” says

Dr. Haisley. “So, instead of trying to fit in with traditional

corporate environments, female entrepreneurs have the

opportunity to establish their own culture in which they

feel more comfortable.”]

[Women, on the other hand, may prioritise the need to achieve a better work-life balance or the ability

to juggle work with family responsibilities. These different motivations for entrepreneurship mean that men and women may have different measures of entrepreneurial success. For men, the key metrics may be simple wealth creation for its own sake or even just as a measure of success. Women, by contrast, are more likely to take a broader view and consider a range of non-financial measures.]

[women

can often find themselves excluded from the informal

networks that are an important source of advice and

opportunities. Some academic studies have found

discrimination from male-dominated supplier systems,

such as preferential treatment in the timing and delivery

of orders5. This hostility makes it more difficult for

women to penetrate these networks and establish

the systems and processes that are necessary to run

a successful business.]

- Study have shown that women were more inquisitive than men and more likely to consider the interests of multiple stakeholders before making decision.

- The key to establishing and maintaining a long-term relationship is to connect and build empathywith the customer as an individual.

- The reality is in some fields men will have to compete with other more capable women and women will eventually see more men creeping into what was once women jobs..

- Don’t forget to support the men and boys because they will need to be able love these empowered-independent-educated women.

- Women and men should belong to diverse communities like a peer support groups that have diverse people coming in and teaching others and in return being taught other skills.

- Women should not lose their natural inclination to be loving, mothers, care takers, etc because if women lose this attribute, all communities will fail. It's less likely that men will fill those attributes.

- We cut down our network pool dramatically if we only network with people who look and act like us.

0 click to comment:

Post a Comment